Portfolio

Real Estate In North Vancouver

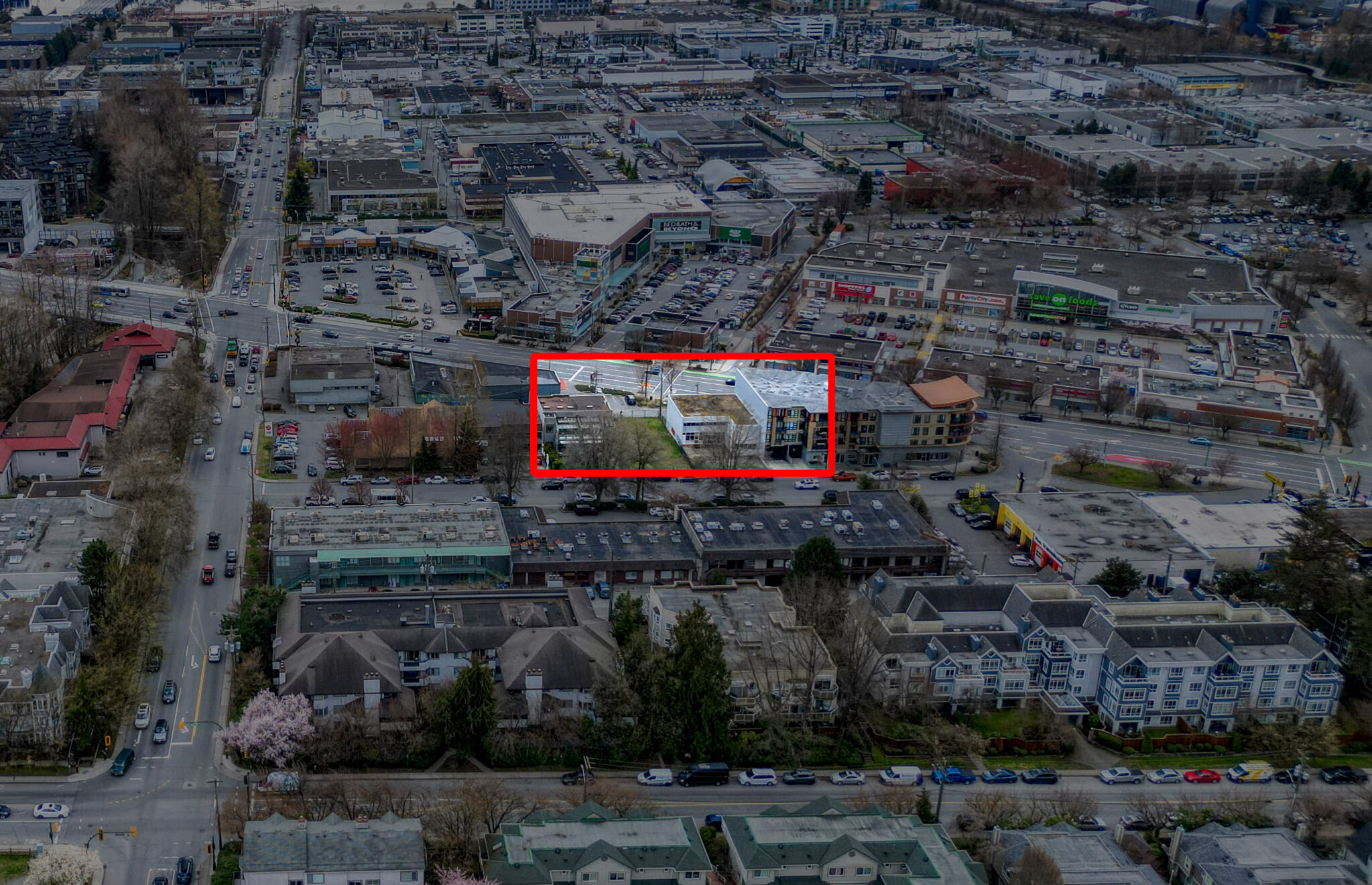

This five-storey apartment building will be situated in the highly desirable neighbourhood of upper Lonsdale, close to the transit system with access to downtown and the beautiful Grouse Mountain Ski Resort.

The building will be composed of various units from studios to three bedrooms to attract a vast range of renters from single working professionals to families who are not in the market to buy. With access to many restaurants, grocery stores, child care center, and community center, this building will be a frontrunner for convenient living in the North Shore making it ideal for REIT investing.

This development consists of a 2-lot assembly with a site area of approximately 11,000 square feet. Conveniently located just 400 meters away from essential amenities such as supermarkets, medical clinics, parks and playgrounds, a shopping plaza, and numerous restaurants, it offers great accessibility to everyday needs.

15th Street is situated on the rapid bus route line, ensuring excellent public transport connectivity. The property was acquired at a favorable price and time, highlighting its potential as a valuable investment.

Investing In The Metro Vancouver Area

Rising Rents

Rent for vacant units continues to rise after it soared in 2022. This forces low turnover rates which ultimately, creates a more challening market for new renters. Considering the limited availability of new units and the significant surge of renters in North Vancouver, investing in this area stands out as one of the more practical, dependable, and lucrative opportunities within the Metro Vancouver Area.

Upward Pressure

The Metro Vancouver Area, particularly North Vancouver, is experiencing significant population growth. This growth coupled with the high costs of entry level homes in the region have drove the rental demand up. Cascadia Green REITs target assets are all in North Vancouver and offer the potential for greater stability and higher returns as the population continues to grow.

CMHC Statistics

| Average Rents (Row / Apartment) | Vacancy Rates | Total Inventory | |||||||

|---|---|---|---|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2022 | 2019 | 2020 | 2021 | 2022 | 2022 | |

| North Vancouver District | $2,032 | $2,112 | $2,155 | $2,464 | 2.6% | 2.8% | 1.3% | 2.8% | 2,464 |

| North Vancouver City | $1,704 | $1,762 | $1,843 | $2,057 | 0.5% | 2.6% | 0.8% | 1.0% | 6,884 |

| West Vancouver | $2,586 | $2,634 | $2,653 | $2,937 | 1.2% | 2.5% | 1.0% | 1.1% | 2,409 |

Start Investing And Contact Us Today.